All ETFs are topic to administration charges and bills; refer to each ETF’s prospectus for more info. All stock and ETF gross sales are subject to a securities transaction payment. Virtually all have eradicated commissions on on-line inventory trading, but there could be main variations elsewhere.

He or she basically acts as a middleman between you and a possible landlord.

Is It Worth Paying A Broker Fee?

Trading fees from a brokerage can kick in when you’re shopping for and promoting shares of inventory, mutual funds or different investments. That’s true whether you’re buying and selling in an internet brokerage account or through a standard full-service dealer. Every dealer is totally different in relation to what fees they cost to commerce and how a lot you’ll pay. Being conscious of buying and selling prices is essential for managing returns in your portfolio, as extreme charges can seriously reduce into what you revenue. You can work with a financial advisor to discover a stability between the proper brokerage and how a lot you’ll be charged in charges.

Brokerage charges are what a dealer costs for varied companies, like subscriptions for premium research and investing data or further trading platforms. Some even cost maintenance and inactivity fees, but generally, you can avoid paying these brokerage fees with the best broker. Full-service brokers offer a broad range of products and services such as property planning, tax consultation and preparation, and different financial providers. Not so long ago, it was not unusual for a full-service broker to cost upward of $100 per commerce for orders positioned with a human broker.

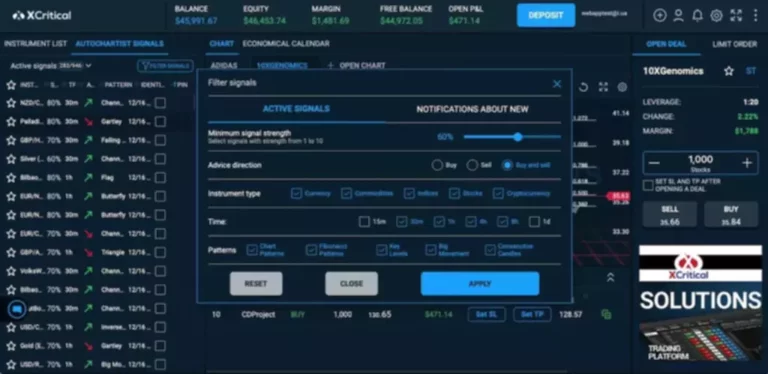

Some brokers supply subscriptions to investing publications, third party research instruments, and even trading apps that you’ll have to pay a monthly or annual subscription charge to use. Finally, one of the best methods to barter dealer service charges and avoid purple flags is to build https://www.xcritical.com/ belief and rapport along with your broker. This means treating them with respect and professionalism, speaking brazenly and honestly, and acknowledging their experience and value. By doing so, you can foster a optimistic and productive relationship that advantages both events.

Mutual Fund Transaction Charge

For on-line brokerages, those charging larger charges than their competitors may convey higher tools that will assist you analysis your subsequent investment. The fees differ and could additionally be based on a per-contract or per-share charge and account maintenance fees can vary between $0 to $50 per account per year. Depending on the broker sort you select, brokerage fees might add up over the lengthy run, decreasing your funding returns.

He’s a graduate of the University of South Carolina and Nova Southeastern University, and holds a graduate certificates in monetary planning from Florida State University. Another way to negotiate broker service fees is to set clear expectations and goals for the dealer’s efficiency and deliverables. For example, you probably can specify the scope and timeline of the project, the standard and quantity of the leads, the level of involvement and communication, and the criteria for fulfillment and evaluation.

How Dealer Fees Impact Your Returns

Fees apply per commerce for all purchases, sales, and exchanges, no matter order size. If you trade shares of a fund for one more fund in the identical fund household and share class, the transaction fee shall be paid out of your settlement fund. You won’t pay a commission to buy or promote Vanguard mutual funds and ETFs online in your Vanguard Brokerage Account. Uncover the names of the choose brokers that landed a spot on The Ascent’s shortlist for the most effective online inventory brokers. Our high picks pack in valuable perks, together with some that supply $0 commissions and big bonuses.

Researching and selecting a broker can be a lengthy and tiresome course of. From experience, no broker is perfect, however you must aim to discover a broker that is reliable, regulated and costs low charges. Thankfully, account maintenance fees are fading and you can see the majority of stockbrokers nowadays won’t charge a upkeep charge. Knowing and understanding dealer fees is crucial, not only for how much it’s going to cost you to take a position or trade however for the impression it’ll have in your backside line. In some instances, a dealer could probably be worthwhile if it weren’t for fees.

What’s A Brokerage Fee?

Also known as dealer fees, they are typically charged if you purchase or promote shares and different investments, or complete any negotiations or supply orders. Vanguard Brokerage may charge a $100 processing payment for every account closure and full switch of account belongings to a different agency. The charge won’t be assessed for shoppers who maintain no less than $5 million in qualifying Vanguard assets or brokerage accounts enrolled in a Vanguard-affiliated advisory service.

Besides the price you’ll pay to commerce shares, mutual funds, ETFs or options, there are some others brokerages can charge. Brokerage fees are costs for various services, corresponding to commerce executions or premium companies like research. They’re usually based mostly on a share of the transaction, a flat payment, or a mix of the two; they are charged by discount, full-service, and online brokers. These fees range by broker however can range from $10 to as a lot as $75. Traditionally, most traders and merchants needed to pay charges to their brokers to execute trades and keep their accounts.

NerdWallet does not and cannot assure the accuracy or applicability of any info in regard to your particular person circumstances. Examples are hypothetical, and we encourage you to hunt personalised recommendation from qualified professionals regarding particular investment points. Our estimates are primarily based on past market efficiency, and past efficiency is not a assure of future efficiency. There are positively some factors that might make it simpler so that you just can negotiate your dealer fee. For instance, if your future rental house is on the luxurious side (and your rent is somewhat high), it is simpler to bargain. In such a case, the brokers fee could be very high to start with (since it’s a proportion of your annual rent), so even if it’s lowered, your broker will nonetheless stroll away with a nice chunk of change.

Other fees—including dividend processing fees—may be withheld by the DTC from the quantity paid by the issuer. Banks that custody ADRs are permitted to cost ADR holders sure fees, as detailed within the ADR prospectuses. All on-line gross sales of CDs earlier than they mature are commission-free. The Ascent is a Motley Fool service that rates and evaluations important merchandise for your on an everyday basis cash issues.

Reduction Of Brokerage Charges To Zero

But once more, make sure no matter strikes you make replicate your fashion. Do your research to determine the best options that fit your personal personal investment fashion. This means that you should not jump on the bandwagon just because a development is scorching or just because the market is shifting a method.

If the broker has the sources and skill to attract a lot of buyers and merchants, offering commission-free stock buying and selling won’t impression their profits a lot. Robinhood Gold is an account providing premium providers available for a $5 month-to-month payment. Margin investing involves the chance of higher funding losses.

Subsequent transactions are the charges shown in the relevant payment schedule. Vanguard Brokerage reserves the proper to finish these presents anytime. Before you sign any agreement with a broker, be positive to understand how they calculate their charges and what they embody. Some brokers could cost a flat charge, a proportion of the deal value, or a mix of each.

This down payment is the sum of money that the borrower should provide you with to put a deposit on the insurance and take out a loan for the stability. The borrower should pay for each the insurance policy or policies and the broker fee. Since this charge is typically broker service fee not financed by the finance company, the down payment must consist of the entire dealer fee plus the deposit portion of the premium (usually 15% — 25%). If you’re buying and selling via a traditional brokerage, the fee may be much larger.